Navigating the complexities of international money transfers can be challenging, but when it comes to how to send money to Iran from USA, the process becomes significantly more intricate due to stringent U.S. sanctions. For many Iranian-Americans, the desire to support family members, facilitate educational pursuits, or provide humanitarian aid remains a powerful motivator, yet the pathways to do so are often obscured by legal restrictions and a lack of clear information. This guide aims to demystify the process, offering a comprehensive look at the permissible avenues, the associated risks, and the essential considerations for anyone looking to send funds to Iran from the United States.

Understanding the landscape of U.S. sanctions against Iran is the first crucial step. These regulations, primarily enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), significantly restrict financial transactions between the two countries. While the general rule is prohibition, there are specific, albeit limited, exceptions and general licenses that permit certain types of transfers. This article will delve into these nuances, providing actionable insights and emphasizing the paramount importance of compliance to avoid severe legal repercussions. Whether you are looking to support a loved one or understand the broader implications of these financial barriers, this guide will equip you with the knowledge needed to make informed decisions.

Table of Contents

- The Labyrinth of Sanctions: Why Sending Money to Iran is Complex

- Permissible Transfers: Navigating Legal Pathways

- Exploring Non-Traditional Methods for Remittances

- Specialized Services and Their Limitations

- The Process of Sending Funds: What to Expect

- Costs, Exchange Rates, and Hidden Fees

- Ensuring Security and Compliance

- The Future Landscape: Potential Shifts in Policy

The Labyrinth of Sanctions: Why Sending Money to Iran is Complex

The primary reason it's so difficult to send money to Iran from USA stems from the comprehensive sanctions program imposed by the United States government. These sanctions are designed to exert economic pressure on Iran, impacting various sectors, including its financial system. Understanding the intricacies of these regulations is crucial before attempting any transfer.

- Yossi Steinmetz Photography

- Carly Jane Leak

- Lily Labeau Porn

- Diva Flawless Nide Videos

- Aiditi Mistry Nude

Understanding OFAC Regulations and Restrictions

The U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) is the leading agency responsible for administering and enforcing economic sanctions programs. When it comes to Iran, OFAC has implemented a broad range of sanctions that largely prohibit U.S. persons from engaging in transactions with Iran or its government, including financial transactions. The term "U.S. persons" is broad, encompassing U.S. citizens and permanent residents, wherever located; entities organized under U.S. law (including foreign branches); and anyone physically located in the United States. This means that if you are a U.S. person, you are generally prohibited from directly or indirectly transferring funds to Iran.

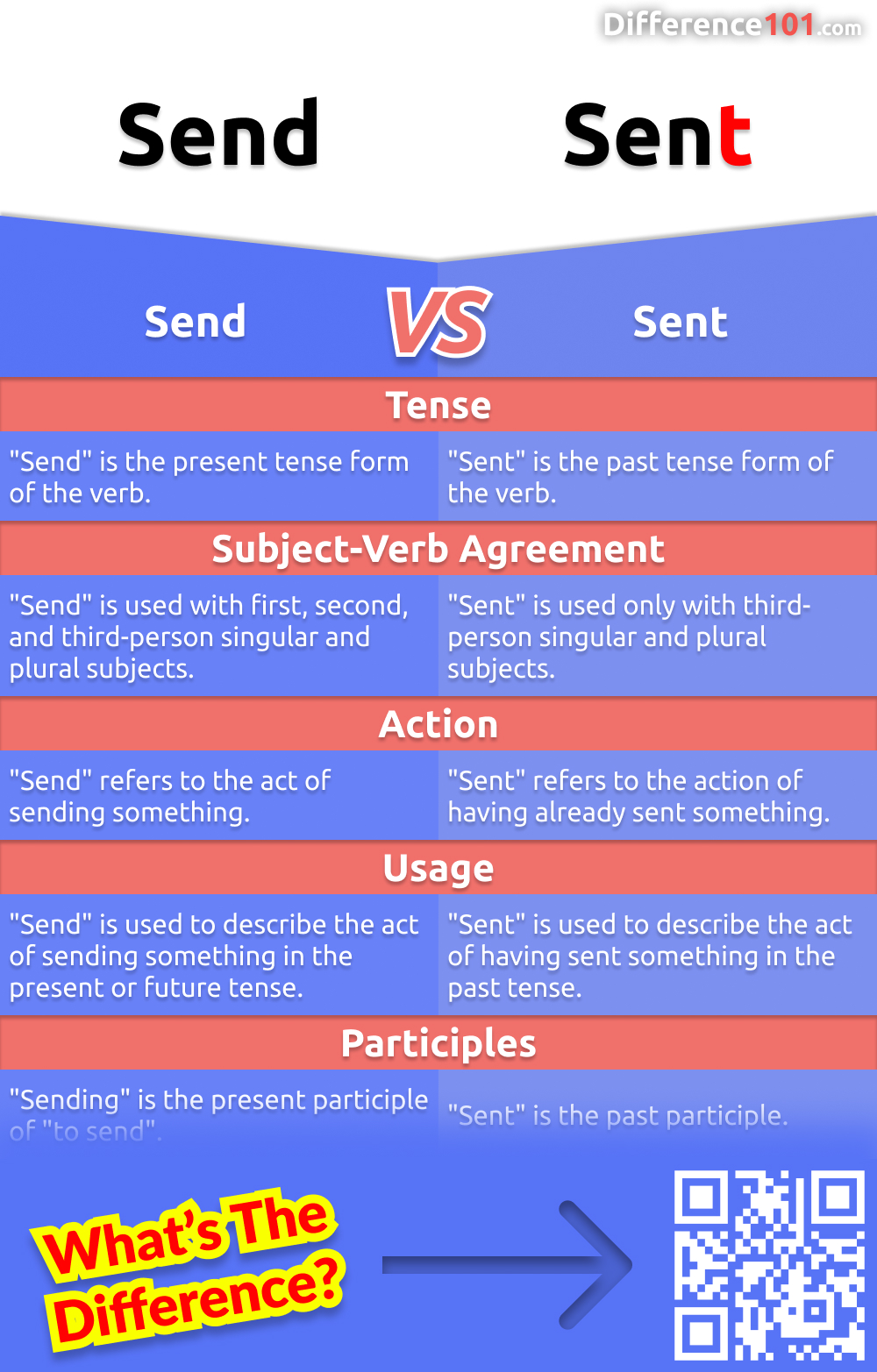

The verb "send" in this context takes on a very specific meaning. It's not just about physically dispatching money; it encompasses any act of transmitting, dispatching, or causing funds to move from one person or place to another. This broad definition is why even seemingly indirect methods can fall under the purview of sanctions. OFAC's regulations are complex, and ignorance of the law is not a defense. Therefore, a thorough understanding of what is permissible and what is not is paramount.

The Impact on Traditional Financial Channels

Due to the sanctions, traditional financial institutions like major banks, credit unions, and wire transfer services (such as Western Union or MoneyGram) are generally unable or unwilling to facilitate direct transactions to Iran. This is because these institutions face significant penalties, including hefty fines and reputational damage, for violating OFAC regulations. Therefore, attempting to "send a person a wire" directly from a U.S. bank to an Iranian bank account is almost certainly impossible and would be flagged immediately.

The global SWIFT (Society for Worldwide Interbank Financial Telecommunication) network, which normally allows for the seamless "transfer from one place or period to another" for financial assets, is largely disconnected from Iranian banks. This isolation means that even if a U.S. bank were willing to attempt a transfer, the infrastructure for a direct transaction often doesn't exist. Consequently, the conventional methods that people rely on for international remittances are simply not viable when you need to send money to Iran from USA.

Permissible Transfers: Navigating Legal Pathways

Despite the broad prohibitions, OFAC does provide certain exceptions and general licenses that permit specific types of transactions, primarily for humanitarian purposes or family support. These exceptions are narrow and come with strict conditions.

- General License D-2 (GL D-2): This is the most significant general license for individuals. It authorizes certain personal remittances to Iran, specifically for non-commercial purposes. This means you can "send" money to family members in Iran for their living expenses, medical care, educational costs, or other non-business-related needs. However, there are crucial limitations:

- The transfers must be made by a U.S. person.

- The recipient must be a close family member (e.g., spouse, child, grandchild, parent, grandparent, sibling) who is ordinarily resident in Iran.

- The funds cannot be transferred to or through any Iranian financial institution that is on OFAC's Specially Designated Nationals and Blocked Persons (SDN) List. This is a significant hurdle, as many major Iranian banks are on this list.

- The transfers must be processed through a third-country financial institution that is not a U.S. person and does not have a U.S. nexus (e.g., a branch in the U.S.).

- There are no specific monetary limits under GL D-2, but the transfers must be "non-commercial" and consistent with the general license's intent. Large, frequent transfers might raise red flags and require further scrutiny.

- Humanitarian Aid: OFAC regulations generally permit the export of humanitarian goods (e.g., food, medicine, medical devices) to Iran. Financial transactions directly related to these authorized exports are also often permissible under specific general licenses or through specific licensing applications. Organizations involved in humanitarian efforts often have established channels for this.

- Academic and Educational Exchanges: Limited transactions related to academic and educational activities, such as tuition payments for Iranian students studying in the U.S. or payments for online courses, may also be authorized under certain general licenses. If you need to "send" funds for these purposes, it's essential to verify the specific conditions.

For transactions not covered by a general license, individuals or entities may need to apply for a specific license from OFAC. This involves submitting an "application form" (sometimes referred to as a "statement of information") detailing the proposed transaction, its purpose, and all parties involved. Obtaining a specific license can be a lengthy and uncertain process, but it is the only legal recourse for transfers that fall outside the scope of general licenses. The request, "I would be very grateful if you would send me the papers," metaphorically highlights the extensive documentation and formal requests often required for such permissions.

Exploring Non-Traditional Methods for Remittances

Given the severe restrictions on traditional banking channels, many individuals explore non-traditional or informal methods to send money to Iran from USA. While some of these methods might appear to bypass sanctions, they often come with significant legal and financial risks.

Informal Channels and Their Risks

Informal money transfer systems, such as Hawala, operate outside conventional banking networks. In a Hawala system, a sender gives money to a Hawaladar (broker) in one country, who then instructs a counterpart Hawaladar in another country to pay the recipient. No physical money "transfer from one place or period to another" actually occurs between the two countries; instead, accounts are settled later through various means, often involving goods or other financial instruments. This method is attractive because it avoids the sanctioned banking system and can sometimes be faster and cheaper.

However, using informal channels carries substantial risks:

- Legality: While Hawala itself isn't inherently illegal in some contexts, using it to bypass U.S. sanctions is. Engaging in unauthorized transactions with Iran, even through informal channels, can lead to severe penalties from OFAC, including civil and criminal charges. The U.S. government views such activities as a violation of its sanctions regime.

- Security: These systems operate on trust, with little to no regulatory oversight. There is no recourse if the money is lost, stolen, or if the Hawaladar defaults. You have no consumer protection, unlike regulated financial services. The risk of someone failing to "send back" your funds if a problem arises is high.

- Vulnerability to Fraud: The lack of transparency makes these systems ripe for fraud. You might give money to someone who promises to "send" it, only for it to disappear.

- Association with Illicit Activities: Because informal channels lack oversight, they are often exploited by criminal organizations for money laundering, terrorism financing, and other illicit activities. Unknowingly participating in such a network could expose you to legal trouble. While you might want to "send a blouse to the wash" or "give these carrots a good wash" to clean something, there's no way to "wash" the illicit connections from these informal channels.

- Physical Risk: In some cases, money might be physically "carried" across borders, which carries risks of theft, confiscation, or even danger to the courier. The act of "carrying" funds directly implies a physical movement that is both risky and often illegal.

The Cryptocurrency Conundrum

Cryptocurrencies like Bitcoin and Ethereum offer a decentralized way to "send" value across borders, theoretically bypassing traditional financial systems. This has led some to consider them as a way to send money to Iran from USA. However, this path is fraught with significant challenges and risks:

- Volatility: Cryptocurrency values can fluctuate wildly, meaning the amount you "send" might be worth significantly less by the time it reaches the recipient, or vice versa. This makes it an unstable medium for remittances.

- Regulatory Uncertainty: While cryptocurrencies are decentralized, the exchanges and platforms used to convert fiat currency to crypto and vice versa are often regulated. U.S. persons using these platforms to facilitate transactions with sanctioned entities or individuals could still violate OFAC regulations. OFAC has issued "notice" warnings regarding the use of virtual currencies to evade sanctions.

- "Off-Ramping" in Iran: The biggest hurdle is converting cryptocurrency into usable Iranian Rial within Iran. The infrastructure for this is limited, and the few available options may be unregulated, risky, or themselves subject to sanctions. It's not as simple as wanting to "send directly" from your crypto wallet to their bank account.

- Anonymity vs. Traceability: While often perceived as anonymous, cryptocurrency transactions are recorded on public ledgers (blockchains). Law enforcement agencies are increasingly sophisticated at tracing these transactions, especially when they interact with regulated exchanges.

- Sanctions Risk: OFAC has explicitly stated that U.S. sanctions apply to virtual currency transactions just as they do to traditional financial transactions. Engaging in virtual currency transactions with sanctioned persons or entities in Iran could still lead to severe penalties.

Specialized Services and Their Limitations

In the highly restricted environment, a few specialized money transfer operators (MTOs) or financial service providers might claim to offer services for sending money to Iran from USA. These services often operate through complex networks involving third countries or specific exemptions. However, their availability is extremely limited, and they come with their own set of considerations:

- High Costs: Due to the complexity, risk, and limited competition, the fees associated with these specialized services are typically very high. The exchange rates offered might also be less favorable than market rates, effectively increasing the cost of the transfer.

- Limited Scope: These services usually cater to very specific types of transactions (e.g., humanitarian aid, academic payments) and may not be available for general family remittances. They often operate under specific licenses or interpretations of general licenses.

- Due Diligence: It is paramount to conduct extensive due diligence on any such service. Verify their legitimacy, their compliance procedures, and their track record. Ask for clear documentation and ensure they are operating within OFAC guidelines. A legitimate service will be transparent about their compliance measures. Be wary of any service that promises to "express the letter to Florida" (i.e., quickly send money) without proper checks, as this could indicate a risky operation.

- Indirect Pathways: Money often does not "flow directly straight" to Iran. Instead, it might be routed through multiple intermediaries in non-sanctioned countries before reaching the recipient. This adds layers of complexity and potential points of failure.

The Process of Sending Funds: What to Expect

If you identify a permissible pathway or a specialized service that operates legally under OFAC guidelines, the process of sending money to Iran from USA will still be far from straightforward. Here's what you can generally expect:

- Verification of Recipient: You will need to provide detailed information about your recipient in Iran, including their full name, address, national ID, and relationship to you. The service provider will need to verify that the recipient is not on any sanctions lists.

- Purpose of Transfer: You must clearly state the non-commercial purpose of the funds, such as family support, medical expenses, or education. This aligns with the requirements of General License D-2.

- Documentation: Be prepared to provide extensive documentation. This could include proof of your relationship with the recipient, invoices for medical expenses, or enrollment letters for educational purposes. Just as you might request, "I would be very grateful if you would send me the papers" for a crucial matter, financial institutions will require their own set of supporting documents.

- Compliance Checks: The service provider will conduct rigorous compliance checks to ensure the transaction adheres to all OFAC regulations. This might involve delays as they verify every detail. They will likely require you to fill out a detailed "application form" or similar statement of information.

- Transfer Mechanism: Funds will typically be sent via a third-country bank that has no U.S. nexus and is willing to process transactions to Iran under the specific license. This is not like sending "this parcel by post" through a standard postal service; it's a highly specialized and limited financial pipeline.

- Receipt and Confirmation: Once the funds are dispatched, it may take time for them to reach the recipient. Confirmation of receipt is crucial. You might receive an "account of what I owe" in terms of fees and the exact amount sent, but tracking can be less transparent than with standard international transfers.

Costs, Exchange Rates, and Hidden Fees

When you attempt to send money to Iran from USA, be prepared for higher costs compared to typical international transfers. The limited legal avenues and the inherent risks associated with processing these transactions mean that service providers charge a premium.

- Transaction Fees: These can be a flat fee per transaction or a percentage of the amount sent. Given the specialized nature, these fees are often significantly higher than those for transfers to non-sanctioned countries.

- Exchange Rates: The exchange rate offered by the service provider can significantly impact the final amount received by your beneficiary in Iran. These rates may not always be competitive with the official market rate or the black market rate in Iran. Always inquire about the exact exchange rate that will be applied before initiating the transfer. A less favorable exchange rate acts as a hidden cost, reducing the effective value of the money you "send."

- Correspondent Bank Fees: Since transfers often go through intermediary banks in third countries, these banks may levy their own fees, which can further reduce the amount received. These "interbank" fees are often not transparently communicated upfront.

- Recipient Fees: In some cases, the recipient's bank or the final payout agent in Iran might also charge a fee for receiving the funds.

It's crucial to get a clear breakdown of all potential costs before committing to a service. Ask for the total amount the recipient will receive after all deductions. This due diligence helps you understand the true cost of sending money to Iran from USA.

Ensuring Security and Compliance

Given the legal complexities and potential risks, ensuring the security and compliance of your money transfer to Iran is paramount. Neglecting these aspects can lead to severe financial penalties and legal repercussions.

- Verify Legitimacy: Only use services that are transparent about their OFAC compliance and have a verifiable track record. Be extremely cautious of any service that promises to bypass sanctions easily or offers rates that seem too good to be true. Look for official registrations and licenses in the countries where they operate.

- Understand the Rules: Familiarize yourself with OFAC's General License D-2 and any other relevant regulations. The more you understand the rules, the better equipped you will be to identify non-compliant services. OFAC periodically issues "notice" updates and guidance, which you should review.

- Keep Records: Maintain meticulous records of all transactions, including the amount sent, the date, the service provider used, the recipient's details, and the stated purpose of the transfer. This documentation is crucial if OFAC ever inquires about your transactions.

- Avoid Risky Channels: Steer clear of informal networks or individuals who offer to "carry" money physically or use methods that seem to operate in a legal grey area. These are often unregulated and high-risk, potentially exposing you to fraud or legal violations.

- Seek Expert Advice: If you are unsure about the legality of a specific transaction or service, consult with a legal expert specializing in U.S. sanctions law. This is especially true for larger sums or complex situations. Their guidance can help you avoid inadvertently violating the law. Remember, the goal is to "send" your support legally and safely, not to put yourself at risk.

The Future Landscape: Potential Shifts in Policy

The landscape of U.S. sanctions against Iran is dynamic and subject to change based on geopolitical developments and shifts in U.S. foreign policy. What is permissible today might change tomorrow, and vice versa. For instance, negotiations related to Iran's nuclear program or changes in U.S. administrations can lead to modifications in sanctions policies, potentially impacting the ease or difficulty of sending money to Iran from USA.

It is crucial for individuals seeking to "send" funds to Iran to stay informed about any policy changes. Official announcements from OFAC and reputable news sources should be regularly monitored. While a complete lifting of financial sanctions seems unlikely in the near future, any adjustments could affect the available legal channels, the types of transactions permitted, or the financial institutions involved. Being aware of these potential shifts ensures that you continue to comply with the law and utilize the most up-to-date and secure methods for your remittances. The ability to "send again" or "send back" funds due to policy changes or failed transfers is a real concern, underscoring the need for continuous vigilance.

Important Considerations Before You Send

Before you commit to any method for sending money to Iran from USA, take a moment to consider these final points:

- Recipient's Access: Even if you successfully send funds, ensure your recipient in Iran can access them. Banking infrastructure in Iran can be challenging, and some local banks may have their own restrictions or difficulties in processing international funds, even those that are legally transferred.

- Purpose is Key: Always remember that the primary legal avenue for individuals is for non-commercial, personal remittances. Any attempt to "send" money for business or investment purposes would likely be a violation of sanctions.

- Patience is a Virtue: The process will likely be slower and more cumbersome than sending money to other countries. Be prepared for delays and additional verification steps.

- No Guarantees: Even with legitimate services, there are no absolute guarantees due to the volatile nature of international relations and the strict regulatory environment.

The act of wanting to "send" financial support to loved ones carries deep emotional significance, often representing a desire to convey "best wishes" for their well-being. However, when it comes to Iran, this simple act is complicated by a web of regulations. Navigating how to send money to Iran from USA requires diligence, patience, and a steadfast commitment to legal compliance.

Sending money to Iran from USA is a complex undertaking, primarily due to the extensive U.S. sanctions regime. While direct traditional banking channels are largely blocked, specific general licenses, particularly General License D-2, offer narrow legal pathways for personal, non-commercial remittances to close family members. Informal channels and cryptocurrencies present high risks of legal violation, financial loss, and association with illicit activities, and should generally be avoided. Specialized services may exist, but require rigorous due diligence due to their high costs and limited scope.

Ultimately, successfully and legally sending money to Iran from USA hinges on a thorough understanding of OFAC regulations, careful selection of compliant services, and meticulous record-keeping. Always prioritize legality and security over convenience or lower costs. If in doubt, seeking professional legal advice is the wisest course of action. Your commitment to supporting your loved ones is understandable, but it must be balanced with strict adherence to the law. We encourage you to share your experiences or questions in the comments below, or explore other related articles on our site for further insights into international financial transfers.

Related Resources:

Detail Author:

- Name : Lois Ullrich

- Username : lacey.cummerata

- Email : orlando67@hotmail.com

- Birthdate : 1987-04-28

- Address : 56906 Wunsch Cliffs Murrayside, HI 24852-1032

- Phone : 979.904.2488

- Company : Wisoky-Cronin

- Job : Auditor

- Bio : Laboriosam ad eius eum autem fugiat sapiente nesciunt. Ex ut unde nihil ex. Distinctio sunt harum consequatur sint earum quaerat aut. Deleniti sit tempore neque rem est omnis.

Socials

instagram:

- url : https://instagram.com/orpha.murphy

- username : orpha.murphy

- bio : Atque mollitia quos qui voluptatem ab optio. Consequatur culpa et et iure sed.

- followers : 4738

- following : 830

linkedin:

- url : https://linkedin.com/in/omurphy

- username : omurphy

- bio : Aut sed repellat omnis.

- followers : 5370

- following : 1129